Labor Management Support Business

Service

We also develop our track record of dispatch transactions and know-how in Vietnam in Japan for over 5,000 companies. Vietnamese employees under the direction of Japanese administrators, carrying out employment contract preparation, payroll calculation, social insurance procedures, etc. While maintaining the same quality as in Japan, it can accommodate both Japanese and Vietnamese languages, reducing the burden on our clients.

Labor management for Vietnamese corporations

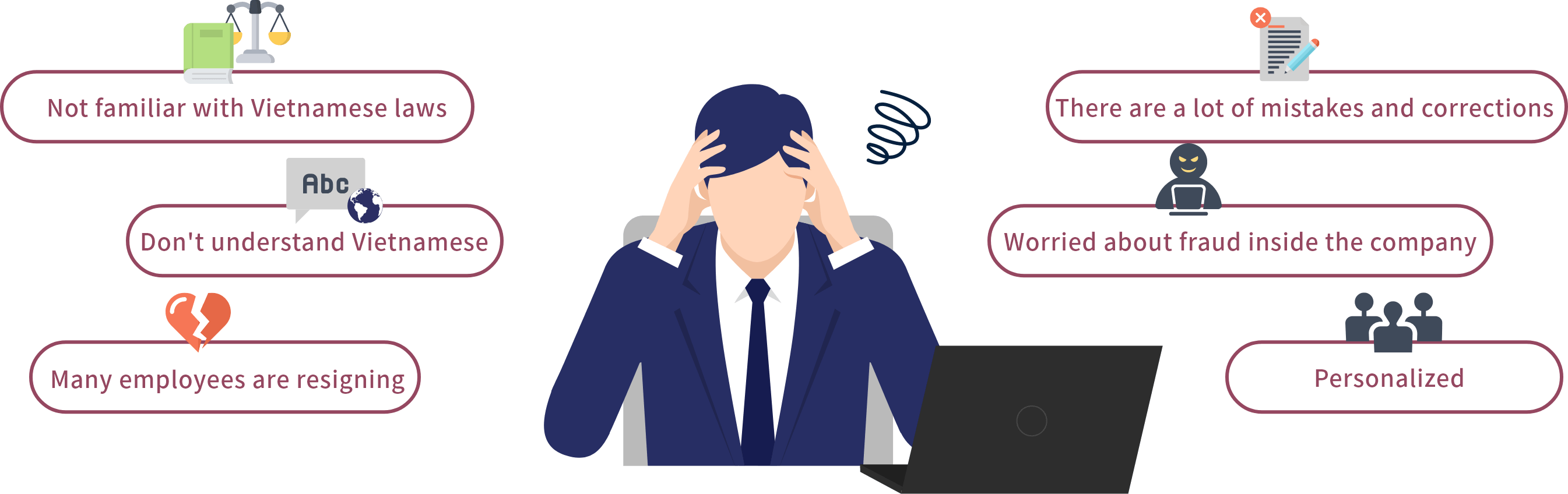

Are you having trouble?

Labor management needs to be careful

in countries with different cultures.

WITH VIETNAM CAMCOM’S LABOR MANAGEMENT SUPPORT We provide a one-stop service

-

Peace of mind with

Japanese supportWe will respond in Japanese from the time of sending and receiving communications. Various forms will be written in Vietnamese and Japanese or English. Administrative procedures documents can be explained separately in Japanese translation.

-

Appropriately respond to Vietnamese laws,

tax systems and their revisionsWe will take appropriate measures at any time, such as insurance premiums and income taxes associated with salary increases, as well as changes to insurance premium rates and taxable income due to legal amendments.

-

Accuracy and information sharing through the use of packaged software

The flow programmed into the application provides accurate calculations. In addition, employee information and salary information are integrated and managed using ASP, so information can be checked and downloaded from outside Vietnam at any time.

-

Security is also safe

You will be entered by fingerprint authentication to the office. In an environment where outsiders do not enter, we are constantly educating our staff on personal information management awareness.

100companies

are using it!

Reduced labor management burden

-

CASE1.

◯◯companies

When establishing a Vietnamese corporation, we wanted to implement control over Vietnamese corporations as a Japanese corporation, but there were some issues that we didn’t understand about the legal systems and procedures in Vietnam, and there were no employees within the company who could understand Vietnamese.

Effects after use

Effects after use

All the legal systems and procedures in Vietnam were explained in Japanese, and it was very smooth. In terms of pay processing, we are also able to create both Vietnamese and Japanese, and we also handle daily email and other exchanges in Japanese, so we are able to respond smoothly, just like our subsidiaries in Japan.

-

CASE2.

◯◯companies

Although we were doing internal payroll calculations, there were many chief accountants and employees in charge who were responsible for resignation, and there were many handovers and many processing errors, so we were busy dealing with them. Furthermore, the management and procedures were left almost entirely to local Vietnamese people, and the company was turned into a black box, with fraudulent disposal such as overtime and inflated allowances being carried out.

Effects after use

Effects after use

By outsourcing, there is no need to prepare employees in the company, and there is no need to understand the frequently changed legal system, pass it on, and carry it out internally. Also, since VIETNAM CAMCOM is a Japanese corporation, they are checking the quality almost the same as in Japan, so the details are detailed and fraudulent processing is no longer available, so there is no need to worry about payroll, and we can concentrate on our sales activities and core work.

Service Lineup

-

Labor Contracts

・ Preparation of probationary period contract

・ Preparation of employment contract

・ Preparation of change contracts -

Salary Calculation

・Monthly salary calculation (Includes income tax/insurance premium calculations)

・Create pay slips

・Create a salary schedule

・Bonus calculation -

Insurance Procedures

・Insurance enrollment, loss procedures, etc.

・Sickness benefits, maternity allowances, maternity leave applications, etc. -

Income tax

・Preparation of weekly tax returns

・Preparation of annual income tax returns

・Registration of personal tax code

・ Application for dependent exemption

FAQ

Can I have overtime work in Vietnam? What should I be careful about?

Wages [Article 98 of the Labor Law]

Regular overtime is 150% or more, weekly holidays (public holidays) days require 200% or more, and 300% or more on public holidays (including Teto New Year) and paid holidays in addition to one day’s wages.

Time [Article 107 of the Labor Law]

・Do not exceed 50% of normal working hours per day

If a weekly working hours are specified, the working hours per day must exceed 12 hours and not exceed 40 hours per month.

・Do not exceed 200 hours per year (up to 300 hours for certain industries)

What is the system for transfer holidays in Vietnam?

What’s the difference between it and Japan?

<賃金>[労働法98条] 通常の残業は150%以上、週休(公休)日は200%以上、祝日(テト正月含む)と有給休暇日は1日の賃金に加えて300%以上の支払が必要です <時間>[労働法107条] ・1日の通常の労働時間数の50%を超えないこと 週当たりで労働時間を規定している場合は、1日あたり労働時間は12時間を超え、1か月あたり40時間を超えないこと ・年間あたり200時間を超えないこと(特定の業種は300時間まで)

Is there a special leave system in Vietnam?

<賃金>[労働法98条] 通常の残業は150%以上、週休(公休)日は200%以上、祝日(テト正月含む)と有給休暇日は1日の賃金に加えて300%以上の支払が必要です <時間>[労働法107条] ・1日の通常の労働時間数の50%を超えないこと 週当たりで労働時間を規定している場合は、1日あたり労働時間は12時間を超え、1か月あたり40時間を超えないこと ・年間あたり200時間を超えないこと(特定の業種は300時間まで)

How are paid leave granted in Vietnam?

<賃金>[労働法98条] 通常の残業は150%以上、週休(公休)日は200%以上、祝日(テト正月含む)と有給休暇日は1日の賃金に加えて300%以上の支払が必要です <時間>[労働法107条] ・1日の通常の労働時間数の50%を超えないこと 週当たりで労働時間を規定している場合は、1日あたり労働時間は12時間を超え、1か月あたり40時間を超えないこと ・年間あたり200時間を超えないこと(特定の業種は300時間まで)